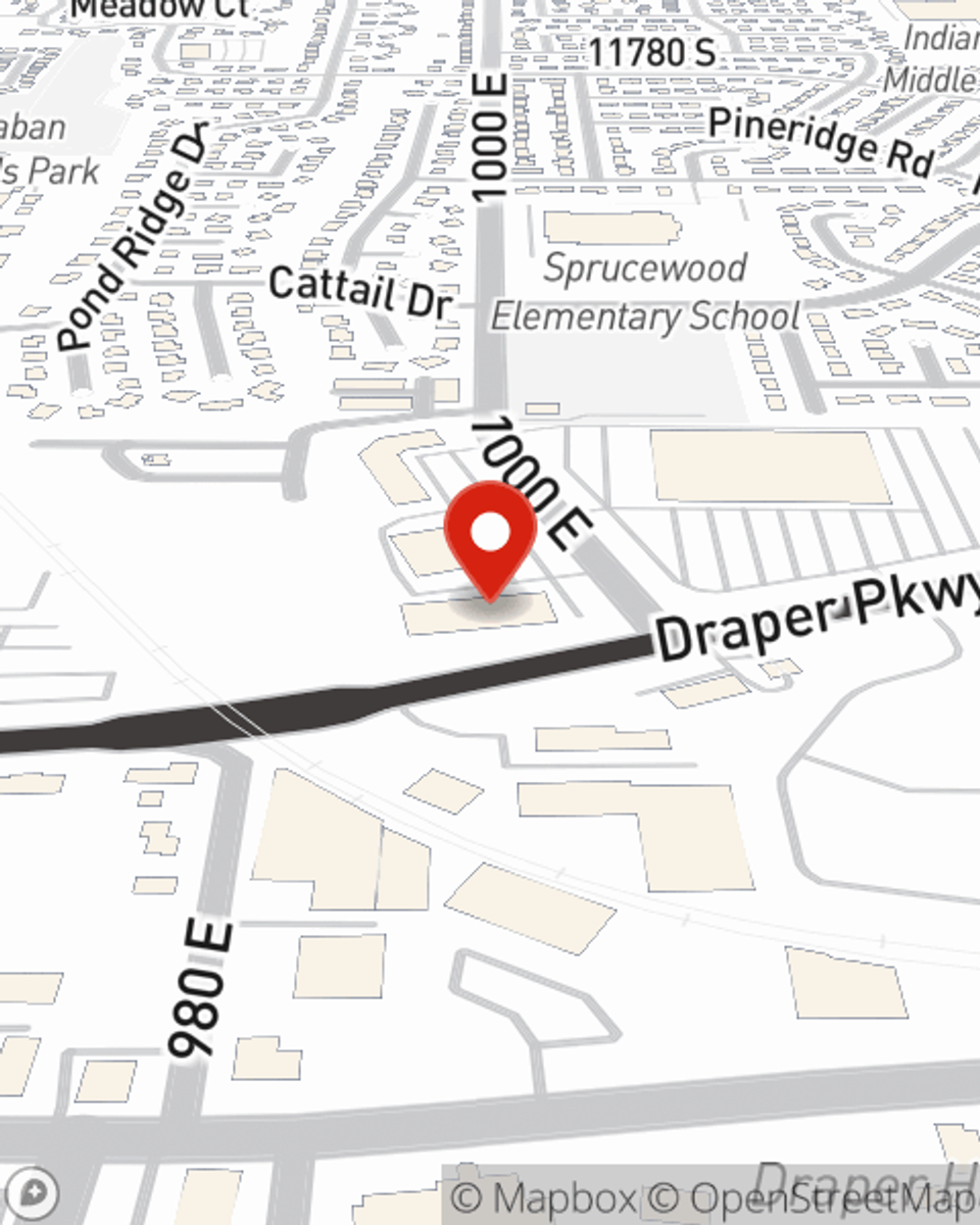

Business Insurance in and around Draper

One of Draper’s top choices for small business insurance.

Cover all the bases for your small business

Insure The Business You've Built.

Though it's not a pleasant thought, it is good to recognize that some things are simply out of your control. Accidents happen, like a customer stumbles and falls on your property.

One of Draper’s top choices for small business insurance.

Cover all the bases for your small business

Insurance Designed For Small Business

With options like errors and omissions liability, a surety or fidelity bond, extra liability, and more, having quality insurance can help you and your small business be prepared. State Farm agent John Matson is here to help you customize your policy and can assist you in submitting a claim when the unexpected does occur.

Curious to discover the specific options that may be right for you and your small business? Simply reach out to State Farm agent John Matson today!

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

John Matson

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.